Tax Brackets 2025 Federal Married Joint. If you were married on december. Income tax brackets for 2025 are set.

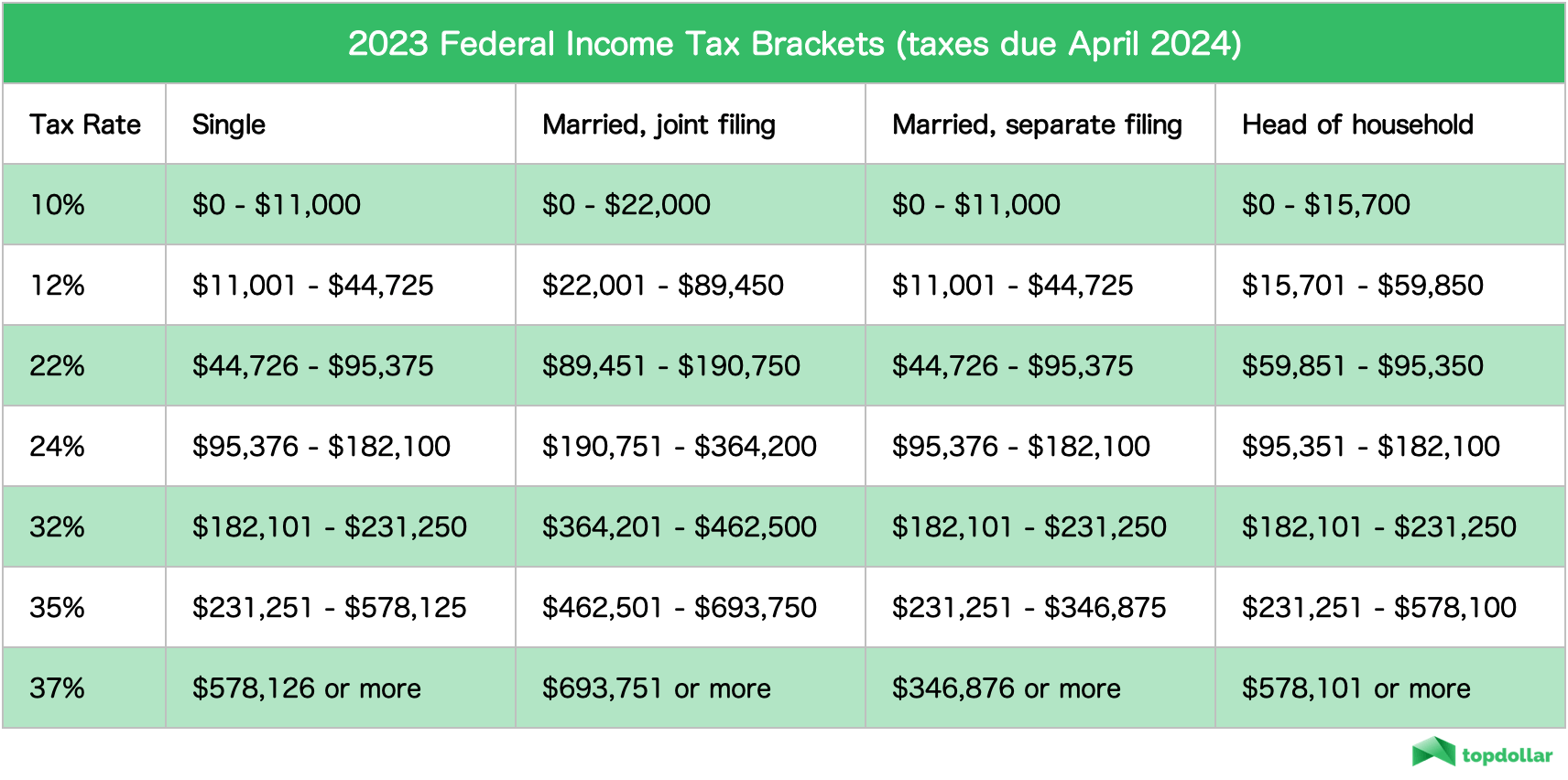

The internal revenue service (irs) has designated seven federal tax brackets that apply to both the 2025 tax year (the taxes you file in april 2025) and the. These bracket types allow taxpayers filing as married filing jointly or head of household to pay less in taxes by widening (doubling, in the case of mfj) each tax bracket’s width.

2025 Us Tax Brackets Irs Rezfoods Resep Masakan Indonesia, Find out your 2025 federal income tax bracket with user friendly irs tax tables for married individuals filing joint returns, heads of households, unmarried individuals, married. As your income goes up, the tax rate on the next layer of income is higher.

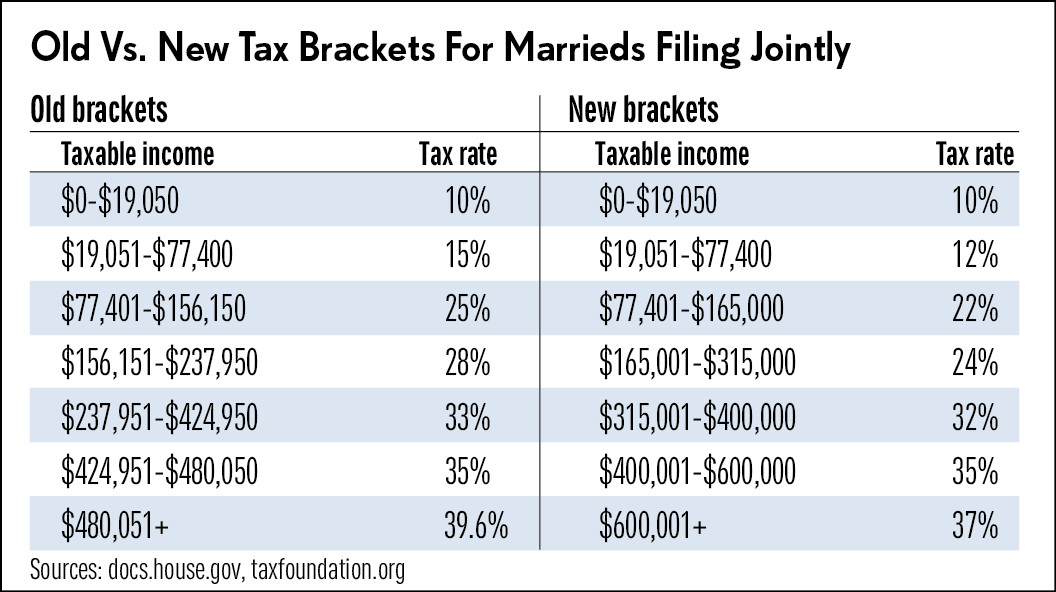

Use The New Tax Brackets to Minimize 2017 Taxes, Knowing your federal tax bracket is essential, as it determines your. While the tax code generally favors joint returns, some spouses may benefit from filing apart, experts say.

Federal Tax Revenue Brackets For 2025 And 2025 Nakedlydressed, Last updated 21 february 2025. How many tax brackets are there?

The Truth About Tax Brackets Legacy Financial Strategies, LLC, The tax brackets and income phaseouts will be updated in irs publication 17, your federal income tax, and irs publication 970, tax benefits for education,. As your income goes up, the tax rate on the next layer of income is higher.

Here are the federal tax brackets for 2025 vs. 2025, The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $609,350 for single filers and above $731,200 for married couples filing. As everyone expected, the irs adjusted the 2025 rates for this crazy inflation we’re.

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, Gains on the sale of. 2025 tax brackets and federal income tax.

10+ 2025 California Tax Brackets References 2025 BGH, 8 rows what are tax brackets? Up to $23,200 (was $22,000 for 2025) — 10%;.

Tax tables 2025 brandingnored, For married couples who file a joint tax return, the 2025 income brackets and corresponding tax rates are as follows: Taxable income 2025 taxtaxable income (single) payable amount (married filing jointly) 10% up to $11,600 10% of the taxable income 10% up to $23,200 10% of.

Virginia Tax Brackets 2025 Ardys Winnah, As your income goes up, the tax rate on the next layer of income is higher. Bloomberg tax & accounting released its 2025 projected u.s.

Federal Payroll Tax Tables Elcho Table, Tax brackets for married filing jointly in 2025. The top marginal income tax rate of 37 percent will hit taxpayers with taxable income above $609,350 for single filers and above $731,200 for married couples filing.

The irs has adjusted federal income tax bracket ranges for the 2025 tax year to account for inflation.

While the tax code generally favors joint returns, some spouses may benefit from filing apart, experts say.