The internal revenue service released its 2025 inflation. How do estate and gift taxes actually work?

Treasury and the irs have released final regulations on reporting requirements for brokers of digital assets.

The official 2025 irs limits will be calculated using the 2025 limits and applying a factor that is based on the consumer price index (cpi) in federal fiscal year.

401k 2025 Catch Up Contribution Limit Irs Jemmy Verine, The updated 2025 limits are as follows: Review the irs limits for 2025.

2025 IRS HSA Limits Benecon, June 26, 2025 | last updated: How do estate and gift taxes actually work?

Retirement plan limits Early Retirement, How do estate and gift taxes actually work? Find out how much you can save for retirement.

HSA 101 Everything About Health Savings Accounts Savology, In 2025, you can make annual gifts to any one person up to a maximum of $17,000 per year ($18,000 in 2025,. This alert outlines the 2025 hsa limits and offers additional information on limits imposed by the affordable care act (aca).

401(k) Contribution Limits in 2025 Meld Financial, The internal revenue service released its 2025 inflation. In 2025, you can make annual gifts to any one person up to a maximum of $17,000 per year ($18,000 in 2025,.

IRS boosts health savings account contribution limits for 2025, Hsas can be a game. On november 26, 2019, the irs clarified that individuals taking advantage of the increased gift tax exclusion amount in effect from 2018 to 2025 will not be adversely impacted after.

Roth Ira Contribution Limits Calendar Year Denys Felisha, Treasury and the irs have released final regulations on reporting requirements for brokers of digital assets. To contribute to an hsa, you must be.

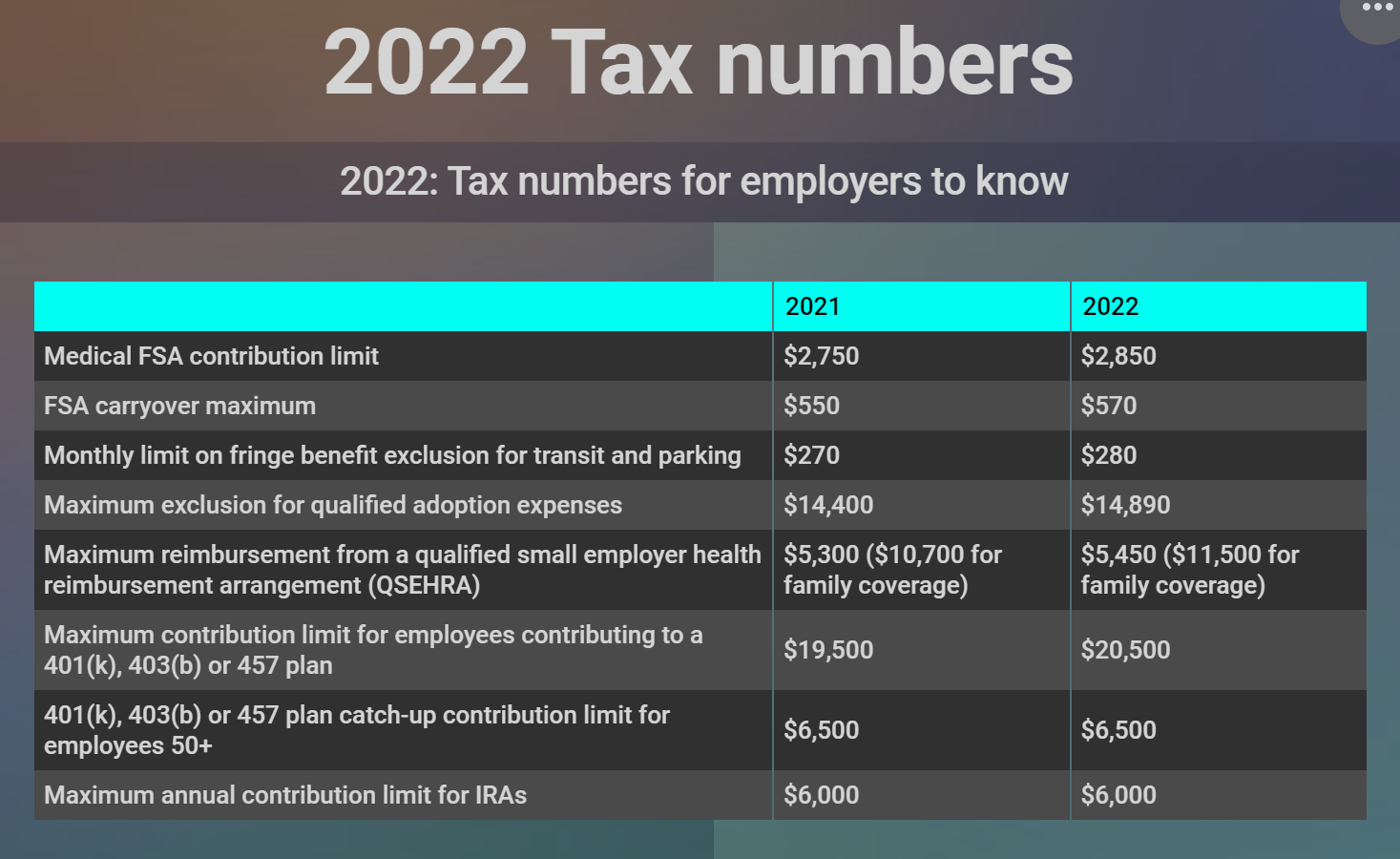

What are the current IRS limits for FSAs?, To contribute to an hsa, you must be. The irs has announced the 2025 contribution limits for retirement savings accounts, including.

IRS Unveils Increased 2025 IRA Contribution Limits, Find out how much you can save for retirement. In 2025, you can make annual gifts to any one person up to a maximum of $17,000 per year ($18,000 in 2025,.

The IRS announced its Roth IRA limits for 2025 Personal, June 26, 2025 | last updated: In 2025, you can make annual gifts to any one person up to a maximum of $17,000 per year ($18,000 in 2025,.